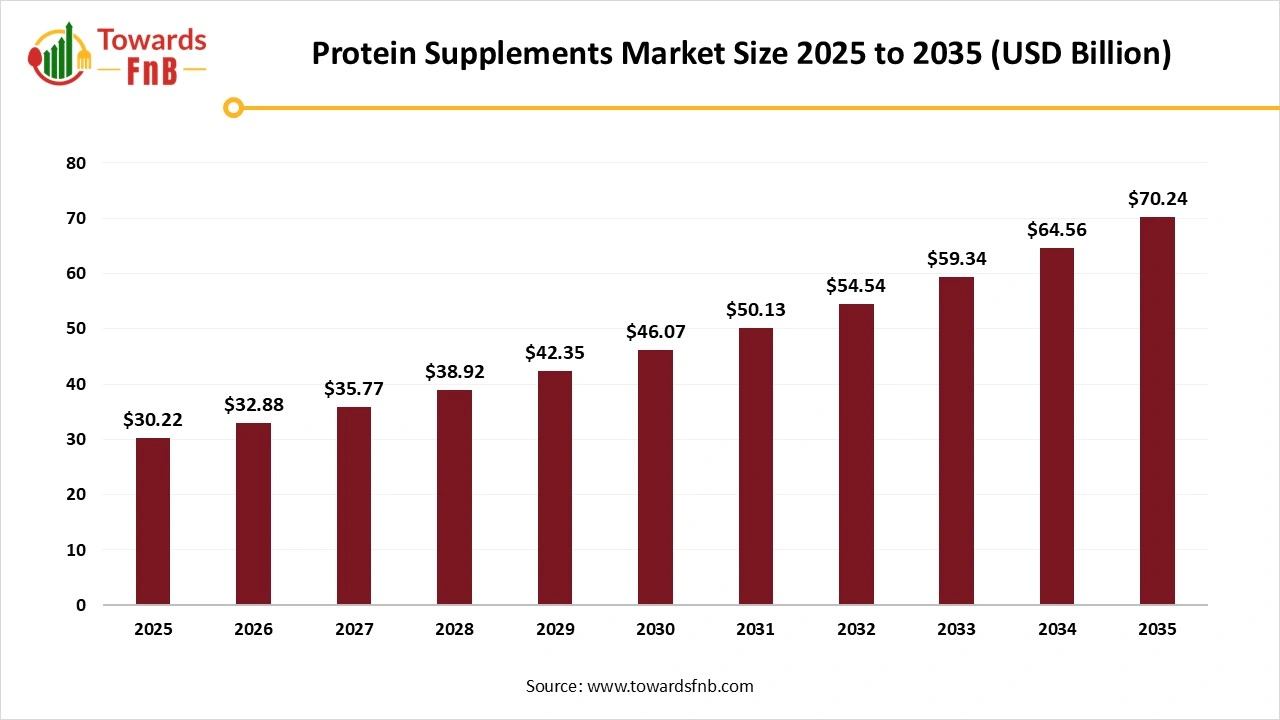

Ottawa, Jan. 27, 2026 (GLOBE NEWSWIRE) -- The global protein supplements market size stood at USD 30.22 billion in 2025 and is predicted to grow from USD 32.88 billion in 2026 to reach around USD 70.24 billion by 2035, as reported by Towards FnB, a sister firm of Precedence Research. The market is anticipated to grow at a compound annual growth rate (CAGR) of 8.8% from 2026 to 2035, indicating strong momentum supported by expanding consumer adoption and product innovation.

The market is observed to grow due to easy and convenient nutrition options, higher demand for healthier and clean options, and a growing population of health-conscious consumers following the health and wellness trends, which is another major factor fueling the growth of the market.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5992

Why this Market Matters Now

Protein supplementation is rapidly transitioning from a niche sports nutrition category into a mainstream component of preventive healthcare, lifestyle nutrition, and aging population support. Rising lifestyle-related health conditions, growing awareness around muscle health and immunity, and demand for convenient, high-quality nutrition solutions are collectively redefining global protein consumption patterns.

The market is observed to grow due to easy and convenient nutrition options, higher demand for healthier and clean-label products, and a growing population of health-conscious consumers aligned with global health and wellness trends, which continues to fuel sustained demand.

Key Highlights of the Protein Supplements Market

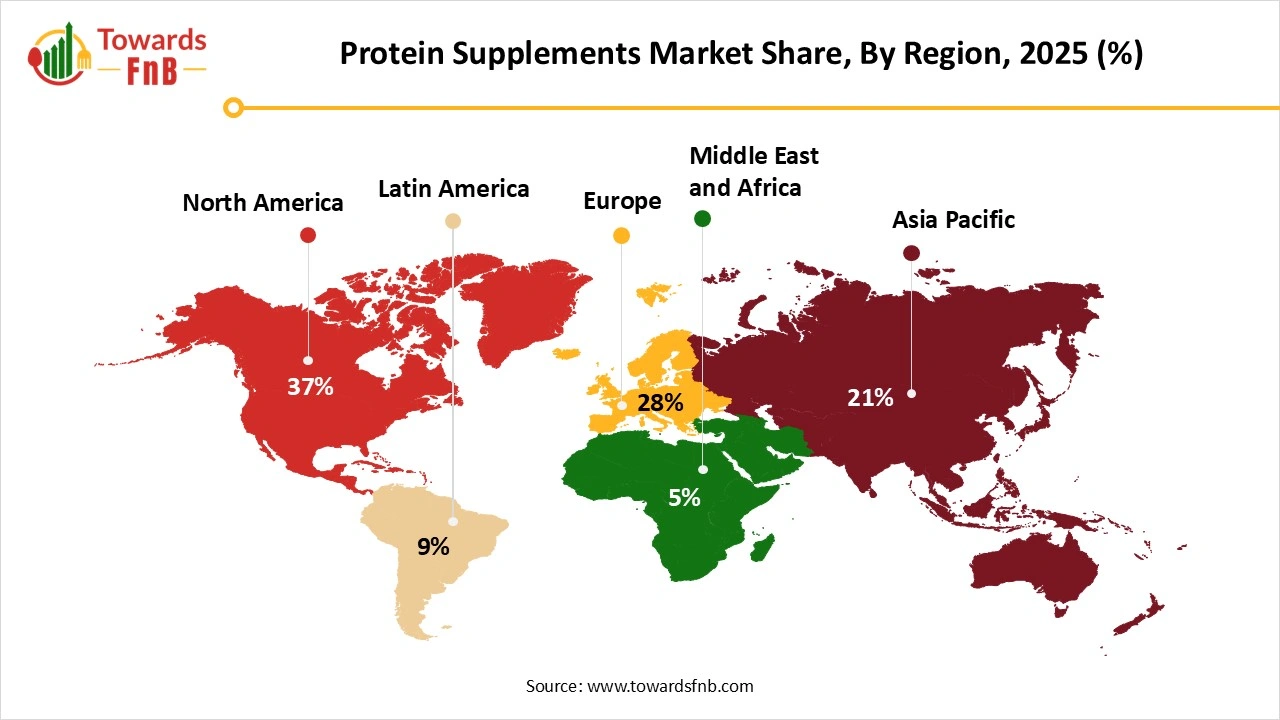

- By region, North America led the protein supplements market with largest share of 37% in 2025, whereas the Asia Pacific is expected to grow in the foreseeable period.

- By source, the animal-based segment led the protein supplements market in 2025, whereas the plant-based segment is expected to grow in the foreseeable period.

- By product, the protein powder segment led the market in 2025, whereas the ready-to-drink segment is expected to grow in the foreseen period.

- By application, the functional foods segment led the protein supplements market in 2025, whereas the sports nutrition segment is expected to grow in the foreseeable period.

- By distribution channel, the online segment led the market in 2025, whereas the supermarket segment is expected to grow in the foreseeable period.

“Protein supplementation has evolved into a foundational nutrition strategy rather than a performance add-on. Innovation in plant-based formulations, ready-to-drink formats, and AI-led product optimization is enabling brands to scale globally while meeting diverse consumer health expectations,” said Vidyesh Swar, Principal Consultant at Towards FnB.

Growing Health and Wellness Trends Fueling the Growth of the Protein Supplements Industry

The protein supplements market is expected to grow significantly due to higher demand for protein supplements, growing health and wellness trends, and higher demand for innovative options. The market is also expected to grow due to growing health issues observed commonly, such as diabetes, cardiovascular issues, obesity, and cholesterol. Protein supplements help to manage weight and repair skin and hair and are also helpful to improve immunity and cut unhealthy fat. Hence, growing health and wellness trends and higher demand for convenient and innovative options also help to fuel the growth of the market.

Technological Innovations Fueling the Growth of the Protein Supplements Market

Technological advancements in the form of microencapsulation for controlled nutrient delivery and advanced fermentation technologies for enhanced plant-based protein, along with AI and automation, which is helpful in the manufacturing process, are some of the major factors fueling the growth of the market. The advancements also help in better nutrient absorption and a higher nutritional profile, further fueling the growth of the market.

Impact of AI on the Protein Supplements Market

Artificial intelligence is increasingly shaping the global protein supplements market by improving formulation accuracy, raw material standardization, and demand planning across sports nutrition, clinical nutrition, and lifestyle wellness segments. Machine learning models analyze large datasets covering amino acid profiles, digestibility scores, solubility behavior, and sensory attributes to optimize blends of whey, casein, soy, pea, and emerging proteins such as rice and fava, ensuring consistent nutritional performance across geographically diverse supply bases. In product development, AI accelerates formulation screening by predicting how protein sources interact with flavors, sweeteners, and processing conditions, reducing issues related to sedimentation, grittiness, or off-notes before scale-up.

During manufacturing, AI-driven process control systems monitor mixing efficiency, spray-drying parameters, agglomeration behavior, and moisture levels to stabilize bulk density, dispersibility, and shelf-life performance across high-volume production runs serving multiple export markets. AI is also applied in global demand forecasting and SKU optimization, where predictive analytics integrate regional consumption trends, regulatory constraints, and distribution data to guide product portfolio decisions. From a quality and compliance perspective, AI supports specification harmonization, contaminant risk screening, and labeling alignment by mapping product attributes against international food safety and nutrition standards referenced by the Food and Agriculture Organization and the Codex Alimentarius Commission.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/protein-supplements-market

Recent Developments in the Protein Supplements Market

- In January 2026, Veracity launched Metabolic Power Protein, a plant-based protein formulated to support muscle development and long-term metabolic health.

- In January 2026, Ambrosia announced its plans to launch a ready-to-mix protein powder made from Solar Foods’ protein in the US.

New Trends in the Protein Supplements Market

- Higher demand for plant-based options by vegans and flexitarians is one of the major factors fueling the growth of the market.

- Technological advancements for product innovation and manufacturing high-quality protein options are another major factor fueling the growth of the market.

- Growing health and wellness trends, along with growing demand for sports nutrition, also help to fuel the growth of the market.

Product Survey of the Protein Supplements Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or User Segments | Representative Brands or Product Types |

| Whey Protein Concentrate | Dairy-derived protein offering balanced amino acid profile and good digestibility | Powdered concentrates, flavored variants | Sports nutrition brands, fitness consumers | Whey protein concentrate powders |

| Whey Protein Isolate | Highly purified whey protein with low lactose and fat content | Powdered isolates, instantized forms | Performance nutrition, clinical nutrition | Whey protein isolate ingredients |

| Whey Protein Hydrolysate | Pre-digested whey protein for faster absorption | Enzymatically hydrolyzed powders | Medical nutrition, sports recovery products | Hydrolyzed whey protein |

| Casein Protein | Slow-digesting milk protein providing sustained amino acid release | Micellar casein powders | Night-time nutrition, meal replacement products | Casein protein powders |

| Plant-Based Protein Supplements | Non-dairy protein supplements derived from plants | Pea, rice, soy, hemp protein blends | Vegan and lactose-free nutrition brands | Plant protein supplement blends |

| Soy Protein Supplements | Complete plant protein derived from soybeans | Isolate and concentrate powders | Vegetarian nutrition, meal replacements | Soy protein supplement products |

| Egg Protein Supplements | High-quality protein sourced from egg whites | Dried egg white powders | Allergen-free and dairy-free nutrition | Egg protein powders |

| Collagen Protein Supplements | Structural protein used for joint, skin, and bone support | Collagen peptides, hydrolyzed collagen | Beauty-from-within, joint health products | Collagen peptide supplements |

| Ready-to-Mix Protein Blends | Multi-protein formulations designed for balanced absorption | Whey–casein blends, plant blends | Sports and lifestyle nutrition | Blended protein supplement systems |

| Specialty Protein Supplements | Proteins designed for targeted health or performance outcomes | High-leucine, fortified protein systems | Medical nutrition, senior nutrition | Specialty protein supplement formulations |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5992

Protein Supplements Market Dynamics

What Are the Growth Drivers of the Protein Supplements Market?

The growing lifestyle-related health issues impacting routine lifestyle activities, such as diabetes, obesity, and cardiovascular problems, are one of the major factors fueling the growth of the market. Higher demand for plant-based protein options in the form of powders, supplements, bars, and snacks demanded by vegans, flexitarians, and vegetarians is another major factor fueling the market’s growth. Easy availability of a variety of options on various platforms is another vital factor helpful for the growth of the market. A growing culture of sports and nutrition, fueling demand for the relatable products, is a vital factor for the market’s growth.

Quality and Safety Issues Hampering the Growth of the Protein Supplements Market

The presence of heavy metals and various other unhealthy elements in the form of sugar and additives is one of the major restrictions in the growth of the market. Hence, it affects the sales of the final product, further hampering the growth of the market. Counterfeiting by using inferior quality ingredients and damaging the quality of the overall product is another major issue obstructing the growth of the market.

Plant-Based Options Fueling the Growth of the Protein Supplements Market

Growing populations of vegans, vegetarians, and flexitarians, leading to higher demand for plant-based options, is one of the major factors fueling the growth of the market. These options are easy to digest, are conscience-free, and are also ideal for consumers who wish to lose weight and manage other health issues accordingly. They are made from soy, pea, and hemp, offering a diverse variety to consumers looking for plant-based options easily.

Protein Supplements Market Regional Analysis

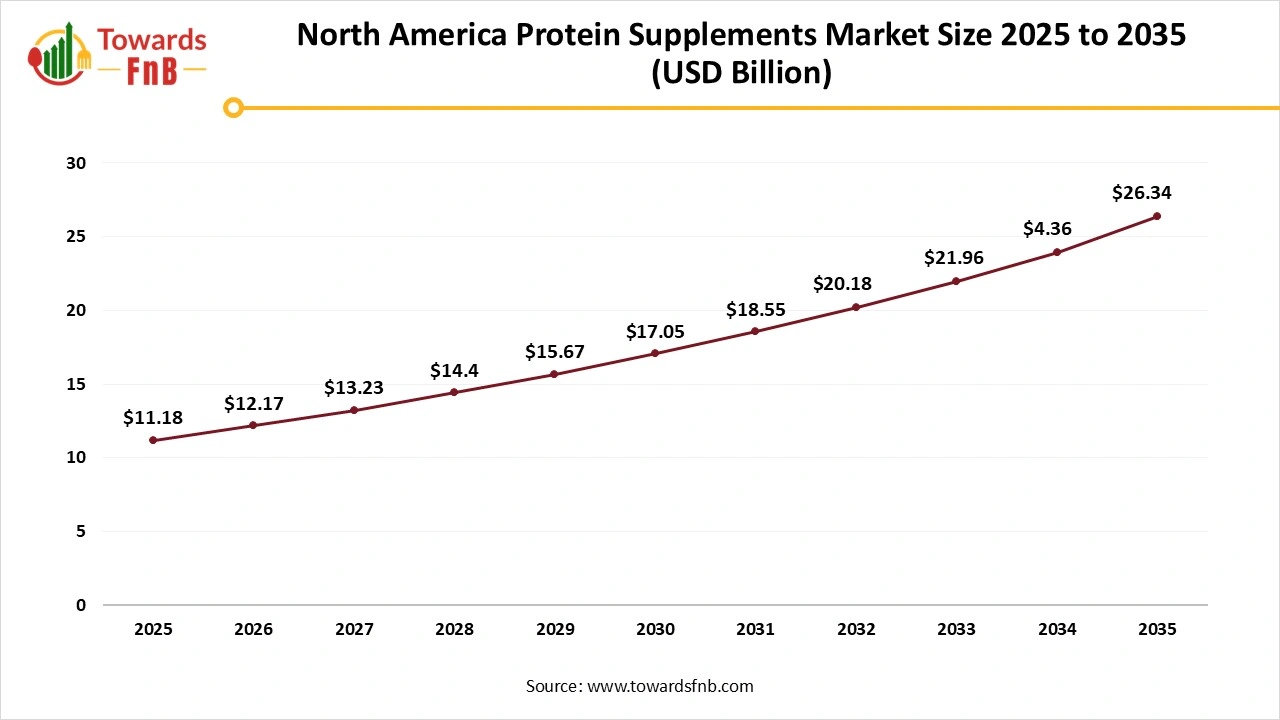

North America Dominated the Protein Supplements Market in 2025

North America dominated the protein supplements market in 2025, due to the growing population of health-conscious consumers following the health and wellness trends, fueling the growth of the market. The market also observes growth due to growing consumer awareness regarding protein for the body, along with other essential nutrients. Hence, it leads to higher demand for protein bar, snacks, and powders, further propelling the market’s growth. The US has made a major contribution to the growth of the market due to higher adoption of active lifestyles and a high following of healthier habits, further fueling the growth of the market.

Asia Pacific Is Observed to Be the Fastest-Growing Region in the Foreseeable Period

Asia Pacific is observed to be the fastest-growing region in the foreseen period due to growing lifestyle-related health issues such as obesity, diabetes, cholesterol, and cardiovascular problems. Growing disposable income, rapid urbanization, growing health and wellness trends, and a growing health-conscious population in the region are other major factors fueling the growth of the market. Higher demand for plant-based options for improved digestion, avoiding allergies, and a growing vegan and flexitarian population also help to fuel the growth of the market. India has made a major contribution to the growth of the market due to the growing trend of preventive healthcare and higher demand for convenient and nutritional options, fueling the growth of the market in the foreseeable period.

Europe Is Observed to Have a Notable Growth in the Foreseen Period

Europe is observed to have a notable growth due to the growing population of the aged segment, leading to higher demand for protein-rich and nutritional supplements. Rising preventive healthcare and higher inclination towards health and wellness trends also help to fuel the growth of the market. Germany has made a major contribution to the growth of the market due to higher demand for protein-rich supplements and the growing health and wellness regimes followed by consumers in the region.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Trade Analysis for the Protein Supplements Market

What Is Actually Traded (Product Forms and HS Proxies)

- Protein supplement powders and mixes (including whey, soy, pea, and blended protein formulations) are commonly traded under HS 21061000 (protein concentrates and textured protein substances) when classified as food preparations or supplements for consumption. (Protein supplement trade data align with this common classification.)

- Whey-based protein supplements, including whey protein concentrate and isolate powders used in sports nutrition and clinical nutrition, are often classified under HS 040410-04041020 when the product is primarily derived from dairy whey. (Whey protein concentrate classifications reflect dairy product chapter codes.)

- Blended and fortified protein supplements containing additional ingredients such as vitamins, minerals, or plant-based blends are typically declared under HS 21069099 (other food preparations not elsewhere specified) depending on composition. (Protein powders with additives trade under broader preparation codes.)

- Ready-to-drink (RTD) protein beverages and bars with protein supplement claims may be traded under separate HS categories specific to beverages or packaged food products that incorporate protein supplements as a key nutritional component. (Classification depends on final product form.)

- Packaging and ancillary materials (containers, bags, sachets) for protein supplements are traded under separate HS headings such as HS 3923 (plastic sacks) or HS 4819 (cartons and boxes) and are not counted as the product itself.

Top Exporters (Supply Hubs)

- United States: A major global exporter of whey-based protein supplements, blends, and specialized sports nutrition products, supported by a large dairy processing industry and established dietary supplement manufacturing.

- Germany: Exporter of high-quality protein supplement powders and plant-based formulations used across European and global markets, linked to advanced food ingredient clusters.

- China: Significant exporter of protein supplement ingredients and finished powders, especially plant-based blends and whey protein products.

- Netherlands: Important export hub for protein concentrates and specialized blend formulations used by European and global food manufacturers.

- India: Growing exporter of plant-based and blended protein supplement products targeting Asia and Middle East markets.

Top Importers (Demand Centres)

- United States: Large importer of premium and niche protein supplement formulations, particularly plant-based and fortified products, driven by consumer demand for health and fitness nutrition.

- European Union: Significant importer of diverse protein supplement products for retail, sports nutrition, and clinical applications, reflecting strong consumer interest in protein-fortified foods.

- China: Major importer of whey-based and plant protein supplement ingredients to support domestic supplement and functional food production.

- Japan: Imports specialized and high-purity protein supplements for sports nutrition and clinical use.

- Mexico and Brazil: Growing markets for imported protein supplements tied to rising middle-class demand and expanded retail channels.

Typical Trade Flows and Logistics Patterns

- Bulk protein supplement powders are typically shipped via containerized sea freight from production hubs in North America, Europe, and Asia to global demand centers.

- High-value specialty blends and whey isolates may be shipped by air freight to meet urgent production or retail replenishment schedules.

- Regional distribution and repackaging hubs handle compliance labeling, quality checks, and local redistribution ahead of delivery to food manufacturers, supplement brands, or retail channels.

- Seasonal demand patterns and marketing cycles (e.g., New Year fitness season) influence freight scheduling and trade volumes.

Trade Drivers and Structural Factors

- Growth in health and wellness trends boosts global demand for protein supplements beyond traditional athletes to general consumers. (Global market size and growth trends reflect this broader adoption.)

- Increasing e-commerce penetration and direct-to-consumer channels support cross-border trade in niche and premium protein supplement products.

- Diversification of protein sources, including plant-based and hybrid formulations, expands export and import activity.

- Nutrition and dietary guidance emphasizing higher protein intake in aging populations, fitness enthusiasts, and clinical nutrition drives repeat import demand.

- Brand innovation cycles and product differentiation encourage manufacturers to source novel ingredients internationally.

Regulatory, Quality, and Market-Access Considerations

- Protein supplements must comply with national food safety and dietary supplement regulations, including permissible ingredients, nutritional labeling, and health claims.

- Allergen declarations (e.g., milk, soy) are critical for customs clearance and consumer safety.

- Classification under specific HS codes influences tariff treatment and documentation requirements during trade.

- In some markets, novel ingredient approval pathways or petition processes may affect import timelines for new protein formulations.

Government Initiatives and Public-Policy Influences

- Public health nutrition policies that promote protein intake indirectly stimulate demand for imported and domestically produced protein supplements.

- Trade facilitation measures and customs harmonization agreements influence tariff rates and procedural ease for protein supplement trade.

- Government support for sports nutrition and fitness initiatives drives awareness and consumption of protein supplements.

Protein Supplements Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Growth Rate from 2026 to 2035 | CAGR of 8.8% |

| Market Size in 2026 | USD 32.88 Billion |

| Market Size in 2027 | USD 35.77 Billion |

| Market Size in 2030 | USD 46.07 Billion |

| Market Size by 2035 | USD 70.24 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Protein Supplements Market Segmental Analysis

Source Analysis

The animal-based segment led the protein supplements market in 2025, due to multiple health benefits of animal-based protein, along with their scientific evidence, fueling the growth of the market. Supportive government schemes and a regulatory framework are another major factor for the growth of the market. The growing lifestyle-related health issues leading to higher demand for highly nutritious or nutrient-dense food options are another major factor for the growth of the market.

The plant-based segment is expected to grow in the foreseen period due to the growing population of vegans, vegetarians, and flexitarians, who are always in search of plant-based options. Factors such as issues in digestion, lowered animal cruelty, lactose intolerance, and allergies are also some of the major factors driving the growth of the market in the foreseeable period. Hence, such factors lead to higher demand for protein options made from pea, soy, hemp, and rice available in the form of protein supplements, protein powders, protein bars, and other edible options, fueling the growth of the protein supplements market in the foreseeable period.

Product Analysis

The protein powder gym led the protein supplements market in 2025, due to higher demand for the product by gymming enthusiasts, athletes, and health-conscious consumers, ensuring they complete their protein intake for the day. The market also observes growth as protein powders are cost-effective, have healthy ingredients, and have stable composition, further fueling the growth of the market. The segment also observes growth due to higher demand for plant-based protein powders by vegans and vegetarians, further fueling the growth of the market.

The ready-to-drink segment is expected to grow in the foreseen period due to its higher demand by consumers with a hectic lifestyle. Such options are nutrient-rich and can be consumed on the go, helpful for consumers with a time crunch, further fueling the growth of the market. Ready-to-drink protein shakes are easy to consume, flavorful, healthy, and highly convenient for consumers who wish to save time and also do not wish to compromise on protein and other nutritional intake. Higher demand for the product by consumers of all age groups is one of the major factors fueling the growth of the market.

Application Analysis

The functional food segment led the protein supplements market in 2025, due to higher demand for healthier and cleaner options, fueling the growth of the market. Such options are enriched with essential nutrients and are also made with clean-label and organic ingredients. Hence, they can be consumed by consumers of different age groups, further fueling the growth of the market. Growing lifestyle-related health issues such as obesity, diabetes, cholesterol, and cardiovascular issues are another major factor fueling the demand for the segment.

The sports nutrition segment is expected to grow in the foreseeable period due to the growing health and wellness trends, fitness culture, and growing awareness regarding the benefits of a healthy lifestyle and routine, which is one of the major factors driving the growth of the market. Factors such as lifestyle management and healthy weight loss are some of the important factors fueling the growth of the protein supplements market in the foreseeable period.

Distribution Channel Analysis

The online segment led the protein supplements market in 2025, due to the convenience provided by the platform, allowing consumers to shop from the ease of their homes. The online platform also has a huge product portfolio, allowing consumers to choose from ample options and shop according to their needs. The platform also provides detailed information and reviews about different products for smarter shopping, further fueling the growth of the market.

The supermarket segment is expected to grow in the foreseeable period due to its easy visibility near residential areas, further fueling the growth of the market. Such stores have separate sections for different types of products, adding convenience to the consumer experience, further fueling the growth of the market. The market also observes growth due to the availability of multiple schemes and discounts provided to regular customers by the shop, further fueling the growth of the market in the foreseeable period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size is increasing from USD 15.71 billion in 2026 and is expected to surpass USD 37.04 billion by 2035, with a projected CAGR of 10% during the forecast period from 2026 to 2035.

- Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

- Canned Food Market: The global canned food market size is projected to expand from USD 144.43 billion in 2026 to reach around USD 218.37 billion by 2035, growing at a CAGR of 4.7% during the forecast period from 2026 to 2035.

- Dietary Supplements Market: The global dietary supplements market size is projected to reach USD 507.33 billion by 2035, growing from USD 229.77 billion in 2026, at a CAGR of 9.2% from 2026 to 2035.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 142.20 million in 2026 to reach around USD 369.70 million by 2035, growing at a CAGR of 11.2% throughout the forecast period from 2026 to 2035.

- Plant-based Protein Market: The global plant-based protein market size is forecasted to expand from USD 22.10 billion in 2026 and is expected to reach USD 46.82 billion by 2035, growing at a CAGR of 8.7% during the forecast period from 2026 to 2035.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 473.40 billion in 2026 to reach around USD 721.91 billion by 2035, at a CAGR of 4.8% over the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 285.66 billion by 2035, growing from USD 182.57 billion in 2026, at a CAGR of 5.1% during the forecast period from 2026 to 2035.

- Vegan Food Market: The global vegan food market size is evaluated at USD 24.77 billion in 2026 and is expected to reach USD 61.85 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

Top Companies of the Protein Supplements Market

- BellRing Brands: BellRing Brands is a leading force in mainstream protein nutrition, driven by its strong ready-to-drink and powder portfolio. The company has helped shift protein supplements from niche fitness products to everyday nutrition solutions. Its emphasis on convenience, taste, and mass retail distribution has accelerated adoption among lifestyle consumers. Strategically, BellRing has strengthened the RTD protein segment and high-frequency consumption models.

- CytoSport Inc.: CytoSport Inc., best known for Muscle Milk, is a pioneer in performance-focused protein supplements. The brand has established strong credibility around muscle recovery and strength support, influencing industry formulation standards. Its gradual expansion into lifestyle nutrition has broadened its consumer base. CytoSport continues to anchor protein’s role in performance-driven nutrition.

- Quest Nutrition LLC: Quest Nutrition LLC is a key innovator in protein-enriched functional foods, particularly protein bars and low-sugar snacks. The company has played a major role in repositioning protein as an everyday food rather than a supplement alone. Its clean-label and low-sugar focus has influenced reformulation trends across the market. Strategically, Quest has expanded protein consumption through snackification.

- GNC Holdings Inc.: GNC Holdings Inc. is a globally recognized nutrition retailer offering a wide range of protein supplements across private-label and third-party brands. The company serves as a major distribution and education channel for protein nutrition. Its private-label portfolio influences pricing and quality benchmarks in the market. GNC’s omnichannel strategy reflects evolving consumer purchasing behavior.

- Iovate Health Sciences International Inc.: Iovate Health Sciences International Inc., known for brands such as MuscleTech, is a science-driven leader in sports and performance nutrition. The company emphasizes clinically supported formulations, reinforcing premium positioning. Its research-backed approach has raised standards for efficacy and claims within the protein supplements market. Strategically, Iovate bridges elite sports nutrition with broader fitness consumption.

Segments Covered in the Report

By Source

- Animal-Based

- Whey

- Casein

- Egg

- Fish

- Others

- Plant-Based

- Soy

- Spirulina

- Pumpkin Seed

- Wheat

- Hemp

- Rice

- Pea

- Others

By Product

- Protein Powder

- Protein bars

- RTD

- Others

By Application

- Sports Nutrition

- Functional foods

By Distribution Channel

- Supermarkets

- Online

- DTC

- Others

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5992

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://ww w.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Meal Kits Market: https://www.towardsfnb.com/insights/meal-kits-market

➡️Ethnic Food Market: https://www.towardsfnb.com/insights/ethnic-food-market